The Role of Technology in Modern Investment Trading Accounts

In the fast-paced world of finance, technology has revolutionized the way individuals and institutions engage in investment trading. Gone are the days when trading was confined to the floors of stock exchanges, with brokers shouting orders and managing trades manually. Today, technology plays a pivotal role in modern investment trading accounts, making the process more efficient, accessible, and user-friendly.

Accessibility and Convenience

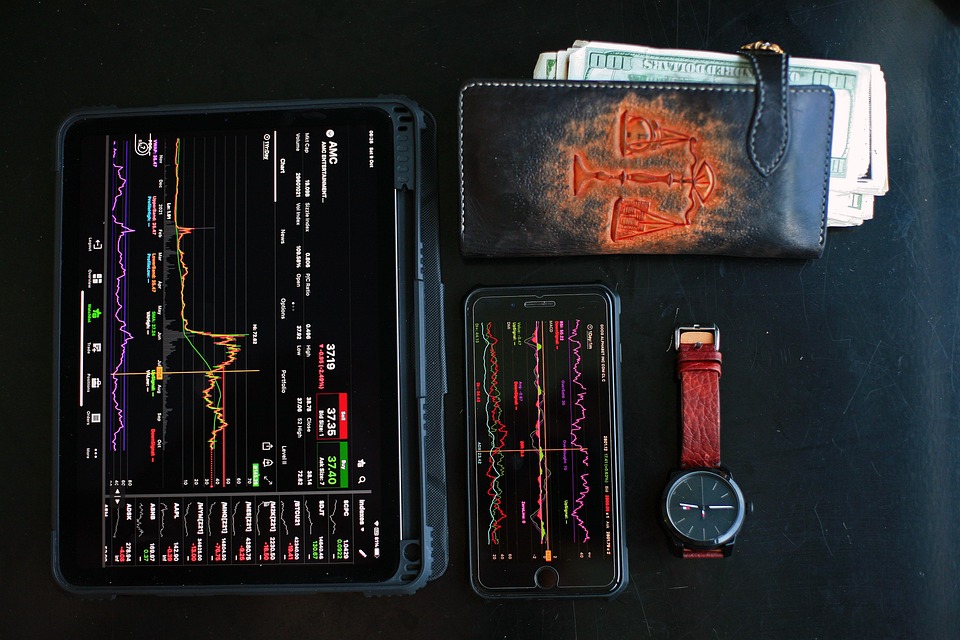

One of the most significant impacts of technology on investment trading is the increased accessibility it provides. With the advent of online trading platforms and mobile applications, investors can now manage their portfolios from anywhere in the world. This convenience allows individuals to trade stocks, bonds, and other financial instruments at their fingertips, breaking down geographical barriers and democratizing access to financial markets.

Moreover, many trading platforms offer user-friendly interfaces that cater to both novice and experienced investors. Educational resources, tutorials, and demo accounts are often available, enabling users to familiarize themselves with the trading process before committing real capital. This accessibility has led to a surge in retail investors entering the market, contributing to a more diverse trading landscape.

Real-Time Data and Analytics

Technology has also transformed the way investors access and analyze market data. Real-time data feeds provide traders with up-to-the-minute information on stock prices, market trends, and economic indicators. This immediacy allows investors to make informed decisions quickly, capitalizing on market movements as they happen.

Advanced analytics tools and algorithms further enhance the decision-making process. Many trading platforms now incorporate artificial intelligence and machine learning to analyze vast amounts of data, identify patterns, and generate insights. These tools can help investors develop strategies based on historical performance and predictive analytics, ultimately improving their chances of success in the market.

Automated Trading and Algorithms

The rise of automated trading systems has been another game-changer in modern investment trading. Algorithmic trading allows investors to set specific criteria for buying and selling assets, enabling trades to be executed automatically without human intervention. This technology can help eliminate emotional decision-making, reduce the risk of human error, and execute trades at optimal prices.

Additionally, high-frequency trading (HFT) has emerged as a prominent strategy among institutional investors. HFT relies on powerful algorithms to execute thousands of trades in fractions of a second, capitalizing on minute price discrepancies. While this approach may not be suitable for all investors, it highlights the growing importance of technology in achieving competitive advantages in the market.

Security and Risk Management

As technology continues to shape the investment landscape, security remains a paramount concern. Modern trading platforms employ advanced encryption and cybersecurity measures to protect sensitive financial information and transactions. Two-factor authentication, biometric verification, and secure servers are just a few of the tools used to safeguard investors’ accounts.

Furthermore, technology has enhanced risk management capabilities. Investors can utilize various tools to set stop-loss orders, monitor portfolio performance, and assess risk exposure. These features enable traders to make more informed decisions and manage their investments more effectively, ultimately leading to better financial outcomes.

The Future of Investment Trading

Looking ahead, the role of technology in investment trading is expected to grow even more significant. Innovations such as blockchain technology, decentralized finance (DeFi), and the integration of virtual reality in trading environments are on the horizon. These advancements promise to further enhance transparency, efficiency, and accessibility in the financial markets.

In conclusion, technology has fundamentally transformed modern investment trading accounts, making them more accessible, efficient, and secure. As the financial landscape continues to evolve, investors who embrace these technological advancements will be better positioned to navigate the complexities of the market and achieve their financial goals. The future of investment trading is undoubtedly intertwined with the ongoing evolution of technology, and those who adapt will thrive in this dynamic environment.